Schedule a FREE, No-Obligation In-Home Design Consultation

Call 888-428-1415, Chat Live or Submit Below

Flexible Financing for Made-to-Order Window Treatments

Ready to upgrade to custom shutters, blinds or shades? We have straightforward financing options through our partner, GreenSky®.

With GreenSky financing options, there’s no reason to put off your new shutters, blinds or shades.

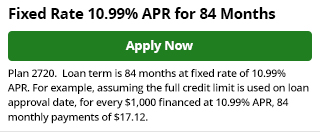

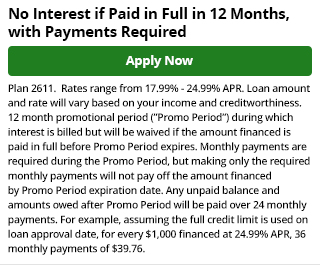

Thanks to special 12-month financing, you have the flexibility to wrap up your project on your own terms. And if you pay your balance off in the promotional period, you won’t see a cent of interest.

Applying for financing with GreenSky is straightforward, secure and offers possible same-day authorization. Work with your Louver Shop consultant to get started.

Financing Details

- GreenSky® financing is subject to credit approval.

- Minimum monthly payments are required during the promotional financing period. However, making minimal monthly payments during the promotional period will not pay off the entire principal balance.

- Interest is billed during the promotional period. But all interest is waived if the purchase amount is paid in full before the promotional period expires.

- Financing for GreenSky® consumer loan programs is provided by federally insured, equal opportunity lender banks.

Frequently Asked Financing Questions

Why should I finance my project when I can pay cash or use a credit card?

Financing a project with a GreenSky® loan allows you to conserve both your money and your equity, and typically offers a lower interest rate than a credit card. GreenSky has many promotional offerings with deferred interest benefits, but without your having to pay out of pocket all at once.***

What type of credit is available?

GreenSky loans are unsecured loans with fixed interest rates. Unlike a revolving credit card, your non-promotional monthly payment amount is always the same.

Where Can I Use My Loan?

Use your GreenSky Account Number to pay for services and products offered by the contractor with whom you apply.

How Do I Make a Payment?

It’s simple – pay online or by phone, or schedule

automatic payments to be drafted from your bank

account. The choice is yours. Call 866-936-0602.

automatic payments to be drafted from your bank

account. The choice is yours. Call 866-936-0602.

How Do I Pay My Contractor?

Once approved, you will be provided a loan agreement and issued a 16-digit account number and expiration date. When you want to pay, just provide these numbers to your contractor to process the purchase as if it were a credit card.

How Long Do I Have to Use My Loan?

Once approved, you have four or six months, depending on your plan to make your purchases.

When Is My First Payment Due?

Depends on your plan. Many deferred interest plans don’t require a payment during the promotional period. The first payment on a budget-minded plan is typically due approximately 30 days after the first purchase.

When Does the Deferred Interest Plan Promotion Window Begin?

At the time of your first transaction.**